oregon wbf tax rate

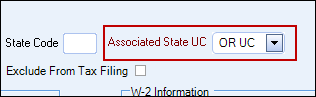

The Edit Employee window opens. Box 4D Use the current LTD tax rate.

Oregon Payroll Tax And Registration Guide Peo Guide

Employers and employees split this assessment.

. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour. The Oregon EITC is 6 of your federal credit with a minimum credit of 24. Calendar Year WBF Rate Employer Portion Employee Portion.

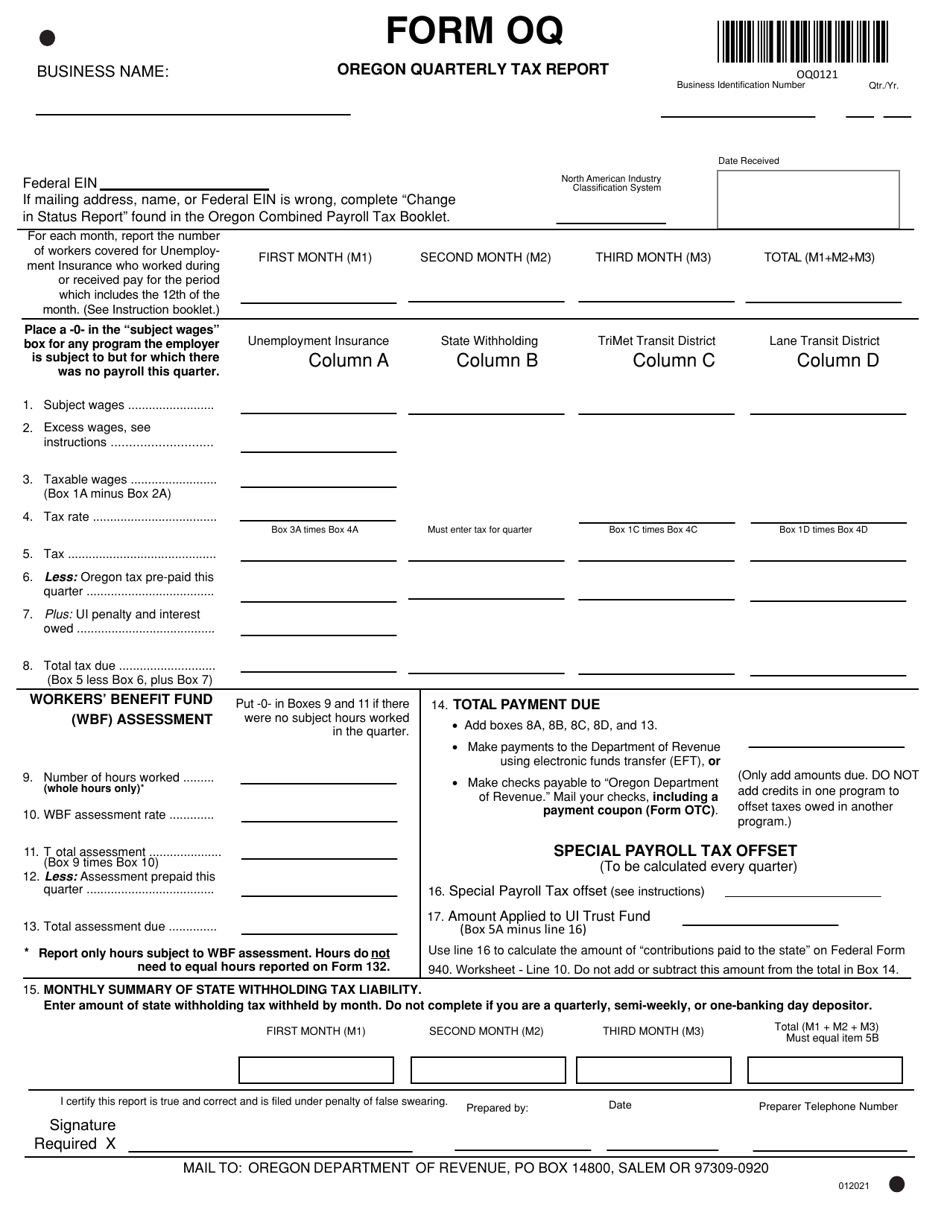

Because the rate stored is still considered a percentage the 100 Line 30 in the tax formula will multiply the number. The 2022 payroll tax schedule is a modest shift down from. Employers use Forms OQ and OTC to.

The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. In the Employee Center double-click on the employees name. 40 hours 0014 056.

Low-income Oregon taxpayers may qualify for free legal or tax help though Oregon DOR recognized charities. Because the rate stored is still considered a percentage the 100 Line 30 in the tax formula will multiply the number. Click the Payroll Info tab.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. Example of how the WBF assessment is calculated This example uses the 2017-2018 WBF rate of 28 cents. The tax rate should be entered in centsdollars and not as a percentage.

For Agency information please see Oregon. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. Wbf assessment for Oregon is based on the number of hours that an employee works.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. Wbfassessmentsdcbsoregongov Assessments Unit DCBSCSDFinancial Services PO Box 14480 Salem OR 97309-0405 Go to wwworegongovdcbswbf for. The detailed information for Oregon Wbf Assessment Rate 2020 is provided.

Example 2016 WBF Rate. 1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the. Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax.

If you are subject to LTD and no tax rate is printed contact the Oregon Department of Rev-enue at 503-378-4988 or 503-945-8091. What is the Oregon WBF tax rate. For example The 2017-2018 rate is 28 cents for each hour or.

Oregon Workers Benefit Fund Payroll Tax. Oregon Workers Benefit Fund WBF assessment Note. 21 in a news release.

Remains at 98 percent in 2023 Self-insured employers and public-sector self-insured employer groups pay 99 percent Private-sector self-insured employer groups pay 103 percent Covers. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. What is the Workers.

Click the Taxes button to display the Federal State. The tax rate should be entered in centsdollars and not as a percentage. QB incorrectly adds vacation hours and holiday hours to calculate this assessment.

1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the state Employment Department said Nov.

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Or Dor Oq Oa 2012 2022 Fill Out Tax Template Online Us Legal Forms

Oregon Payroll Tax And Registration Guide Peo Guide

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Oregon Payroll Tax And Registration Guide Peo Guide

Ernst Young Finds Oregon Has Nation S Lowest Total Effective Business Tax Rate Oregon Center For Public Policy

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

![]()

Oregon Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

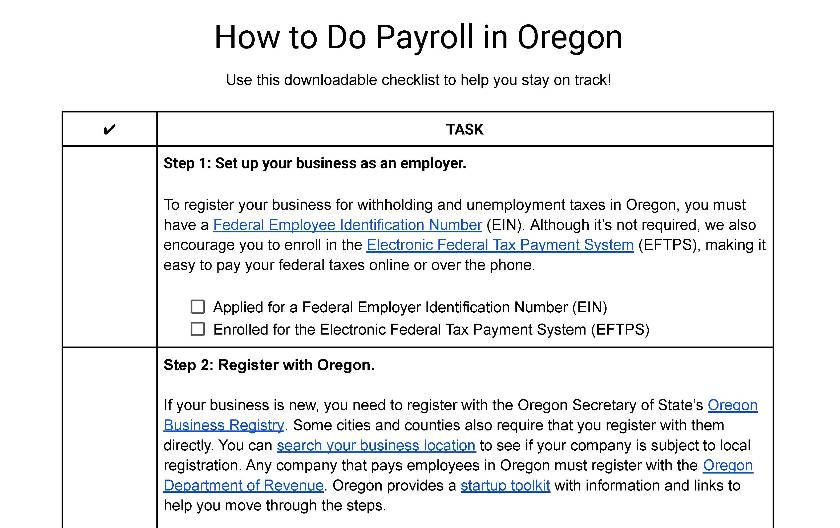

How To Do Payroll In Oregon What Employers Need To Know

Workers Compensation Market Characteristics Report

Oregon Workers Benefit Fund Wbf Assessment

Fillable Online Oregon Workers 39 Benefit Fund Wbf Assessment Oregon Gov Oregon Fax Email Print Pdffiller

My Money Map A Complete Financial Breakdown Financial Mechanic

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Workers Benefit Fund Payroll Tax

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download