salt lake county sales tax

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Beware the Sales Tax Nexus.

The Dark Side Of Rising Home Prices Higher Taxes Opinion Deseret News

The South Salt Lake Utah sales tax is 705 consisting of 470 Utah state sales tax and 235 South Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax a 020 city sales tax and a 080 special district sales tax used to fund transportation districts local attractions etc.

. The value and property type of your home or business property is determined by the Salt Lake County Assessor. The minimum combined 2022 sales tax rate for Salt Lake County Utah is. The list includes the parcel number owner.

The restaurant tax is an additional 1. The auction for 2021s tax sale will be held online hosted by Bid4Assets. The table combines the base Utah sales tax rate of 625 and the local county rates to give you a total tax rate for each county.

If you would like information on property owned by Salt Lake County please contact Salt Lake County Facilities Management at 385-468-0374. What you will find in the US which is different from some other countries is that when you see the price of a product such as a t-shirt in a retail store or food. Essentially the tax sale is an opportunity to buy property for the delinquent taxes owed on the property in an auction format.

5 rows The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax. Tax sale properties will be listed in Intermountain Commercial Record on April 28 2022. Prior to the auction Salt Lake County provides a list of the properties up for auction.

The County sales tax rate is. Sales and Use Tax Salt Lake City Utah has a 685 sales and use tax for retail sales of tangible personal property and select services which include but are not limited to admissions to places of amusement intrastate transportation service and hotel and motel accommodations. State Local Option.

Utah has several different counties 29 in total. This page lists the various sales use tax rates effective throughout Utah. Tax sale property listing will be posted by April 28 2022.

As far as other cities towns and locations go the place with the highest sales tax rate is Salt Lake City and the place with the lowest sales tax rate is Bingham Canyon. A county-wide sales tax rate of 135 is applicable. Surplus Auctions for Salt Lake County - Tax Sale.

The various taxes and fees assessed by the DMV include but are. See Publication 25 Sales and Use Tax General Information. The 2018 United States Supreme Court decision in South Dakota v.

The Utah state sales tax rate is currently. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The current total local sales tax rate in Salt Lake.

This is the total of state and county sales tax rates. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. The Utah sales tax rate is currently.

The Salt Lake County sales tax rate is 135. This is the total of state county and city sales tax rates. 7705 or email to taxmasterutahgov.

RIGHT OF WAY 15-23-154-018-0000. The Salt Lake City sales tax rate is. Estimated Combined Tax Rate 745 Estimated County Tax Rate 135 Estimated City Tax Rate 020 Estimated Special Tax Rate 105 and Vendor Discount 00131.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Salt Lake City UT Sales Tax Rate. A Tax Sale is the public auction of any real property with taxes that have been delinquent for four years from the final tax payment deadline.

On a city level the sales tax percentages are. The most populous location in Salt Lake County Utah is Salt Lake City. Sales taxes do not apply to services.

Sales is under. Salt Lake County Business Owners. Sales Tax and Use Tax Rate of Zip Code 84115 is located in Salt lake city City Salt Lake County Utah State.

States collect sales tax and you could be headed for trouble if your Salt Lake County business isnt addressing the sales tax nexus. Frequently Asked Questions. The average cumulative sales tax rate between all of them is 749.

Sales taxes are applied to a variety of goods including tangible personal property transportation services hotels and food. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. 2 State Sales tax is 485.

3 rows Salt Lake County UT Sales Tax Rate The current total local sales tax rate in Salt Lake. 2022 Utah state sales tax. Exact tax amount may vary for different items.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. If your business sells a lot online then were coming into the most wonderful time.

The salt lake utah sales tax is 685 consisting of 470 utah state sales tax and 215 salt lake local sales taxesthe local sales tax consists of a 135 county sales tax and a 080 special district sales tax used to. The Salt Lake County sales tax rate is. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

22 rows The Salt Lake County Sales Tax is 135. Beware the Sales Tax Nexus. Residential property owners typically receive a 45.

The tax rate on food is 3 statewide. 2 days 20 hours. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here.

A single 500 deposit plus a 35 non-refundable processing fee is required to participate in the Salt Lake County UT Tax Sale.

Utah Sales Tax Small Business Guide Truic

Salt Lake City Utah S Sales Tax Rate Is 7 75

What S Living In Salt Lake City Like 2022 Ultimate Moving To Slc Guide

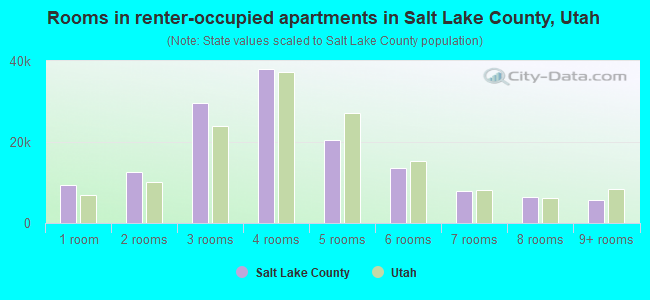

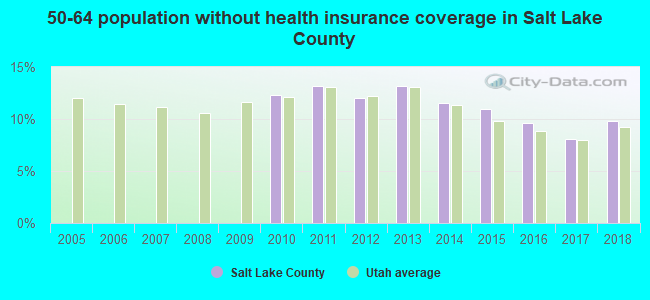

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Salt Lake City Cost Of Living What You Need To Know In 2022

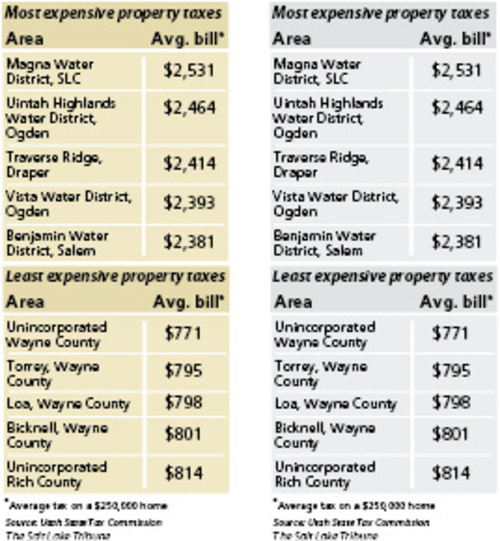

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Salt Lake City Utah Ut Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

![]()

Tax Information Economic Development

Salt Lake County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Utah Centennial County History Series Salt Lake County 1996 By Utah State History Issuu

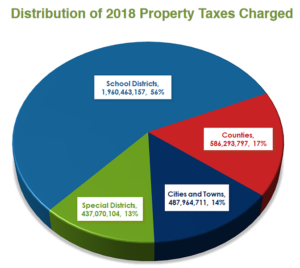

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

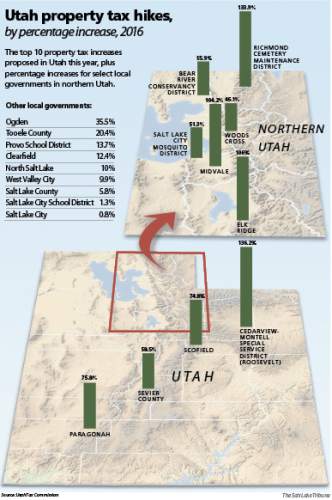

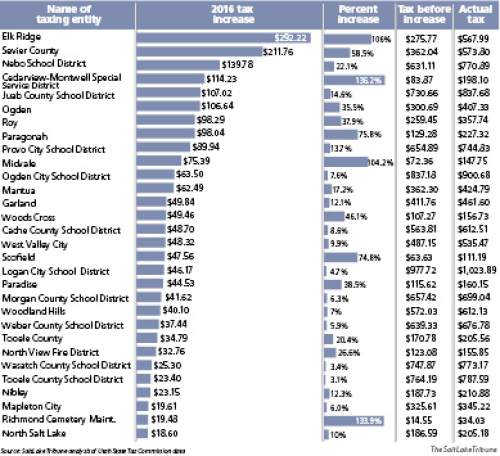

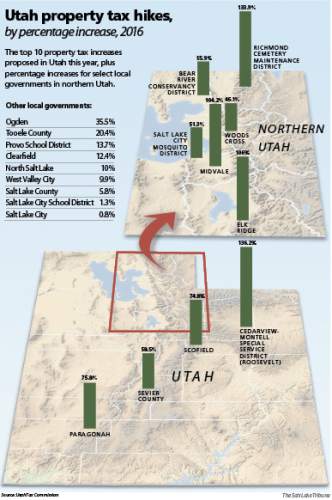

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Airbnb Rules In Utah Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway

Salt Lake City Utah Tourism Visit Salt Lake

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune